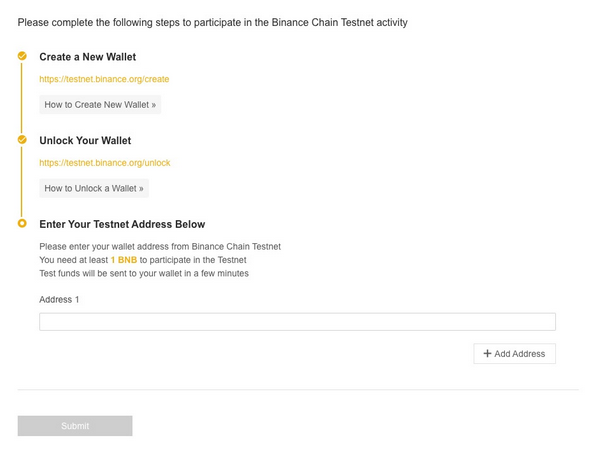

Users now have access to the BNB Chain Explorer, web wallet, public data nodes and APIs, and trading will begin at a later date. Wallets initially supported on BNB Chain include Trust Wallet, Ledger, Enjin, Magnum Wallet, CoolWallet, Coinomi Wallet, Atomic Wallet, ZelCore Wallet, Infinito Wallet, Math Wallet, Ellipal Wallet, Guarda Wallet and Exodus. With the BNB Chain mainnet launch, BNB, the seventh largest cryptocurrency by market cap to date, has migrated from ERC-20 to BEP-2 to become the native asset on BNB Chain, where BNB is used to assist network transactions. We will work closely with projects and teams to grow the entire ecosystem.” We hope this brings a new level of freedom to our community. “With no central custody of funds, Binance DEX offers far more control over your own assets. “We believe decentralized exchanges bring new hope and new possibilities, offering a trustless and transparent financial system,” said CZ (Changpeng Zhao), CEO of Binance. As part of Binance’s effort to push the industry forward, the Binance DEX development team invites projects to participate in and issue new tokens on the native blockchain.

Binance dex api professional#

Most countries allow you to self-declare taxes online in 2023, but you can also get help from a professional tax accountant to file taxes for you.Binance DEX (Decentralized Exchange) launches on its native blockchain, BNB Chain, to empower community growth and foster the industry’s long-term vision of peer-to-peer trading.īinance, the leading global cryptocurrency exchange and ecosystem, joins the community in celebrating the launch of Binance DEX, a decentralized exchange running on the BNB. Luckily, Coinpanda can help you with this and generate ready-to-file tax forms quickly and easily.Īfter downloading your Binance DEX tax statements from Coinpanda, the last step is to report the capital gains and income on your tax return before the deadline. Once you have this data, you can calculate your capital gains or losses by determining the price at which you bought the cryptocurrency (your cost basis) and the price at which you sold it (your proceeds). To calculate your capital gains, you must first export a complete history of all transactions made on Binance DEX. When you have this information ready, you can report capital gains and income together with other forms of income such as employment and dividends in your annual tax return. How do I file my Binance DEX taxes?įirst, you must calculate capital gains and income from all taxable transactions on Binance DEX. To learn more about how Binance DEX transactions are taxed in your country, we recommend reading our in-depth guides to cryptocurrency taxes. Income tax: Earned cryptocurrency on Binance DEX, such as staking, interest, bonuses, and referral rewards, is typically seen as taxable income from a tax perspective and must be reported in your tax return.

On the other hand, if you sell the cryptocurrency for less than you paid initially, you have a capital loss, which can offset other gains in most cases. Capital gains tax: Whenever you sell a cryptocurrency for more than you purchased it for, you generate a capital gain.

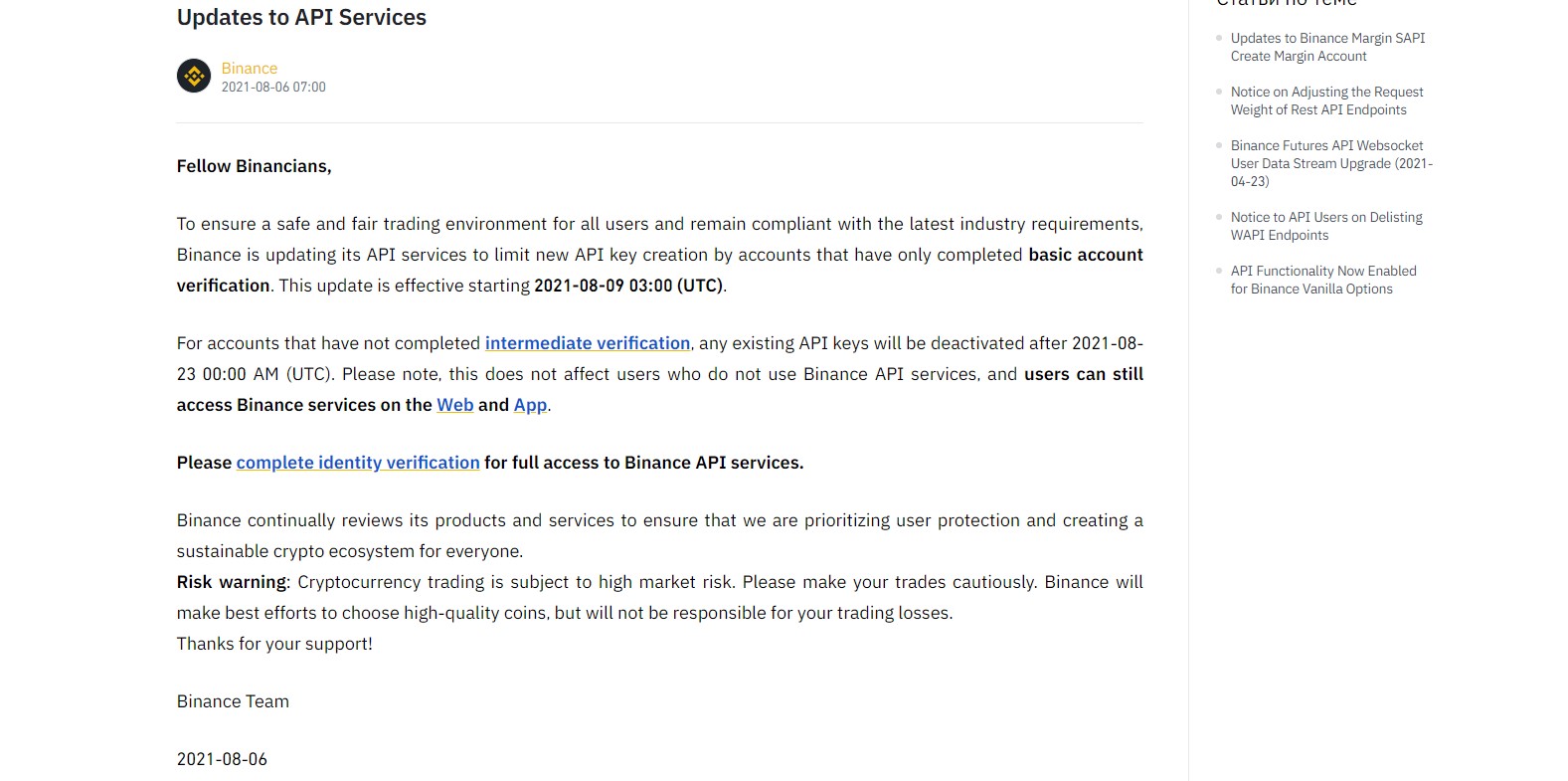

In general, you must pay either capital gains tax or income tax on your cryptocurrency transactions on Binance DEX. The exact tax implications on Binance DEX transactions depend on which country you live in and the type of transactions you have made. Please use API sync with your public address instead. It is currently not possible to export your trades as CSV from Binance DEX.

0 kommentar(er)

0 kommentar(er)